Business Insurance in and around St. Louis

Calling all small business owners of St. Louis!

Helping insure small businesses since 1935

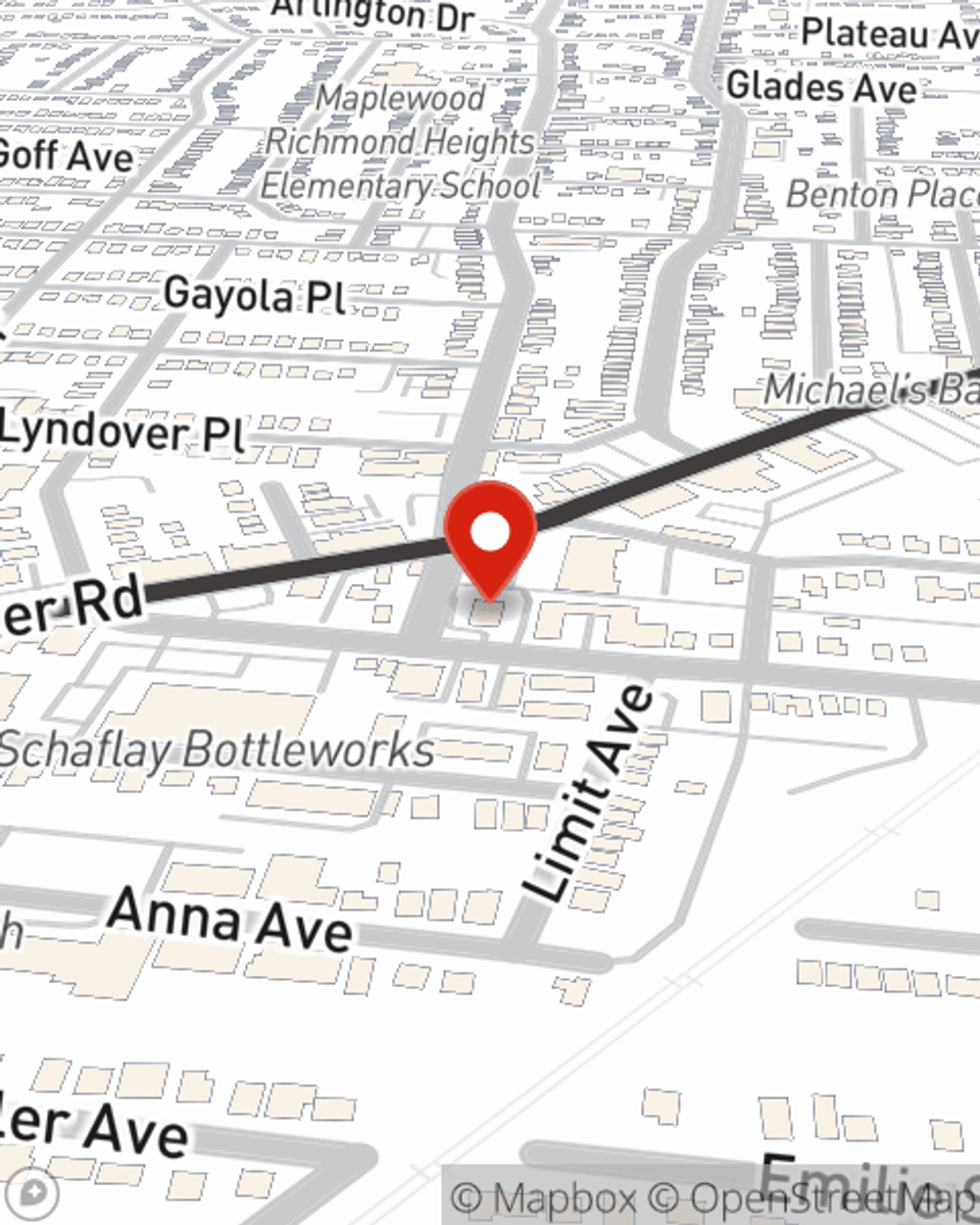

- Maplewood

- Brentwood

- Crestwood

- Clayton

- University City

- Richmond Heights

- Sunset Hills

- Ballwin

- Wildwood

- Creve Coeur

- Fenton

- Arnold

- Maryland Heights

- St. Charles

- St. Peters

- O'Fallon

- Olivette

- Overland

- Florissant

- Hazelwood

This Coverage Is Worth It.

Running a small business comes with a unique set of wins and losses. You shouldn't have to face those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, business continuity plans and errors and omissions liability, among others.

Calling all small business owners of St. Louis!

Helping insure small businesses since 1935

Cover Your Business Assets

Your company is unique. It's where you make your living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just earning a paycheck or a store. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like a surveyor. State Farm agent Brent Mathany is ready to help review coverages that fit your business needs. Whether you are an HVAC contractor, a sporting goods store or a dog groomer, or your business is a pizza parlor, a pet store or a deli. Whatever your do, your State Farm agent can help because our agents are business owners too! Brent Mathany understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Agent Brent Mathany is here to consider your business insurance options with you. Contact Brent Mathany today!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Brent Mathany

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.